Contents:

This type of risk can be caused by a variety of factors such as inadequate capital structure, high-interest rates, increasing prices, currency fluctuations, and more. Simplify how you manage risk and regulatory compliance with a unified GRC platform fueled by AI and all your data. Manage risk from changing market conditions, evolving regulations or encumbered operations while increasing effectiveness and efficiency. A good tip to ensuring that such problems don’t happen in the future is to employ the use of insurance. There are insurances on all sorts of problems that could arise in your business. For example, natural disaster insurance covers all-natural disasters.

- However, every decision about a new product offering, a new target market, or a potential merger has the potential to fail and put the company’s ability to operate at risk.

- Providing comprehensive health coverage – if you’re in America – is an important way to reduce the risk your business faces from health and sickness ups and downs, nevermind contagious illnesses.

- Google Cloud lets you use startup scripts when booting VMs to improve security and reliability.

- There are different types of risks, such as strategic risk, reputation risk and financial risk, that will always exist with every decision you make as an entrepreneur.

- Appearance of new technology renders the old technology as obsolete (i.e. out of use); causing severe financial losses to firms operating with old technology.

- Operational risks involve anything that disturbs a company’s capacity to function, either temporarily or permanently.

Physical what is business risks point to all those risks that present a threat to the business property, material assets, and human resources like fire, theft, water damages, and risk to employees. This type of risk will lead to expenses in the form of cost of repair or replacement. It’s not always the top authority’s fault in the failure of a business, nor is it always the result of the incompetence of the ground level staff.

Security governance, risk and compliance

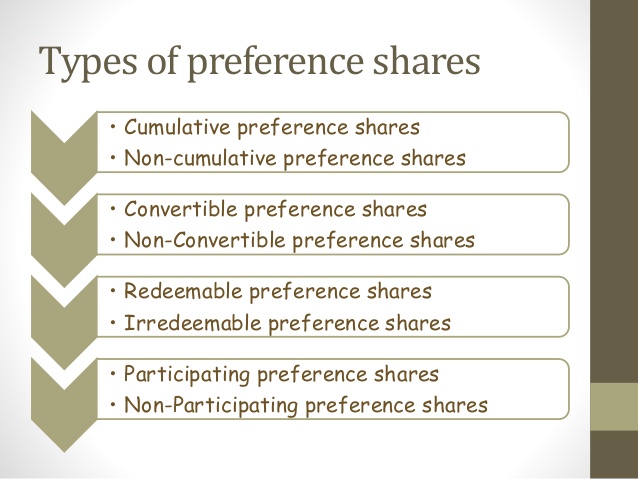

It expects itself to pay to its shareholders a certain rate of dividend and plough back some profits. They are also taking a fresh look at risk appetite statements. A poorly worded risk appetite statement could hem in a company or be misinterpreted by regulators as condoning unacceptable risks.

Business risks are unpredictable and can cause losses to the business. Although the business plan you prepare is pretty good, the risk can still occur, so it becomes a barrier to the development of your business. Let’s take a look at Toyota’s risk management framework and how the company recognises and manages risks.

Numerous factors impact business risk, including sales volume, per-unit pricing, input costs, competition, the broader economic situation, and government restrictions. This can be done either before the business begins operations or after it experiences a setback. Ideally, a risk management strategy will help the company be better prepared to deal with risks as they present themselves.

What is Business Risk

Similarly, when you introduce a new https://1investing.in/, there is a greater risk, so you may refuse to avoid the risk. The business has many risks but it can also be avoided by adopting some measures. Management can adopt the technique to minimize the chance of occurring any particular event which form may cause the loss. No business can avoid risk although the degree of risk may vary Risk can be reduced but cannot be eliminated.

In addition to a focus on internal and external threats, enterprise risk management emphasizes the importance of managing positive risk. Positive risks are opportunities that could increase business value or, conversely, damage an organization if not taken. Indeed, the aim of any risk management program is not to eliminate all risk but to preserve and add to enterprise value by making smart risk decisions. For example, a company may face different risks in production, risks due to irregular supply of raw materials, machinery breakdown, labor unrest, etc. In marketing, risks may arise due to fluctuations in market prices, changing trends and fashions, errors in sales forecasting, etc. In addition, there may be loss of assets of the firm due to fire, flood, earthquakes, riots or war and political unrest which may cause unwanted interruptions in the business operations.

Final Business Risks Quiz

SWOT analysis – assessing business Strengths, Weaknesses, Opportunities, and Threats – is a refined strategy that enables competition identification and impact evaluation. Process Street’s SWOT Analysis Template will guide you through this process. Business risk is concerned with lowered profits and business failure, identifying factors that could contribute. Anything that could cause a business to miss its targets or goals is considered a business risk. Starting a new business or operating a business comes with a degree of risk. Basically, any kind attached largely depends on your type of business, hence, it is important to know the type that is likely to affect your business.

Buy this regional bank which hedged its interest rate risk, Piper says – CNBC

Buy this regional bank which hedged its interest rate risk, Piper says.

Posted: Tue, 28 Mar 2023 14:25:31 GMT [source]

Opportunities and threats are elements in the external environment that may present areas for growth or significant risk to a specific firm. The external business environment, including macroeconomic forces well outside the control of management . Liquidity becomes a much bigger concern for a management team that borrows, as principal and interest payments must be made to service its debt obligations. A company that uses debt in its capital structure becomes susceptible to rising interest rates and is required to adhere to the terms of its various credit agreements.

Risk item 3: Biodiversity loss, cause, and economic effect 🐼

We feature the latest updates in Information Technology, like ERP, which is connected with various industries. A content writer with a strong interest in writing and technology. Chandra is dedicated to writing useful, entertaining, and relevant information for readers, and he continues to develop content that connects and inspires them. For ease of in-depth research, use CRM-Sales Software to help you sell smarter, faster, and more effectively.

Like our already mentioned Risk Management Process checklist. Strategic risk occurs when a business does not run according to its business plan or model. Basically, when a company does not function according to its business model, it weakens its strategy and makes it become less effective over time. Operational risks involve anything that disturbs a company’s capacity to function, either temporarily or permanently.

Economic factors are linked to the possibility of loss due to market changes. Small businesses benefit from operational flexibility and the ability to adapt quickly to changing conditions, making them less vulnerable to business risks. On the other hand, as a company grows in size, its flexibility decreases. Business risks are quite high in today’s world of fierce competition, cutting-edge technology, and economic globalisation.

Alibaba to split into six units – Reuters.com

Alibaba to split into six units.

Posted: Tue, 28 Mar 2023 12:51:00 GMT [source]

Business risk is different from financial risk, which occurs when a company employs significant debt in its capital structure. The reputation of a company is important for its business practices. A company with ruined reputation, is at risk losing the public backing and its customers, thus negatively impacting its brand loyalty.

It is very difficult to secure full coverage against adverse price changes. In addition to using risk management to avoid bad situations, more companies are looking to formalize how to manage positive risks to add business value. The scandal involving the misrepresentation of coronavirus-related deaths at New York nursing homes by the governor’s office is representative of a common failing in risk management. Hiding data, lack of data and siloed data — whether due to acts of commission or omission — can cause transparency issues. As risk expert Josh Tessaro told Lawton, “Many processes and systems were not designed with risk in mind.” Data is disconnected and owned by different leaders. “Risk managers often then settle for the data they have that is easily accessible, ignoring critical processes because the data is hard to get,” Tessaro said.

These risks stem from a variety of sources, including financial uncertainties, legal liabilities, technology issues, strategic management errors, accidents and natural disasters. Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organization’s capital and earnings. These threats, or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters. To be effective, enterprise risk management should assess the risks inherent in specific business objectives, anchored in key value drivers. Business risk refers to the possibility that a company’s earnings will be lower than expected or it will lose money instead of profit.